Securing Your Legacy, Protecting Your Future.

At our firm, we prioritize long-term vision and strategic innovation to drive sustainable financial growth for our clients. By investing in cutting-edge solutions and forward-thinking strategies, we help you achieve lasting success in a dynamic financial landscape.

LET'S CLEAR UP COMMON MISCONCEPTIONS

Many people delay estate planning due to common myths. Here's the truth:

"I Don't Have Enough Assets"

Many believe estate planning is only for the wealthy. This simply isn't true.

The Truth: Estate planning protects what matters to YOU—whether that's a home, savings, digital assets, or ensuring your children are cared for by the right people. If you have loved ones or anything of value, you need a plan.

"It's Too Expensive"

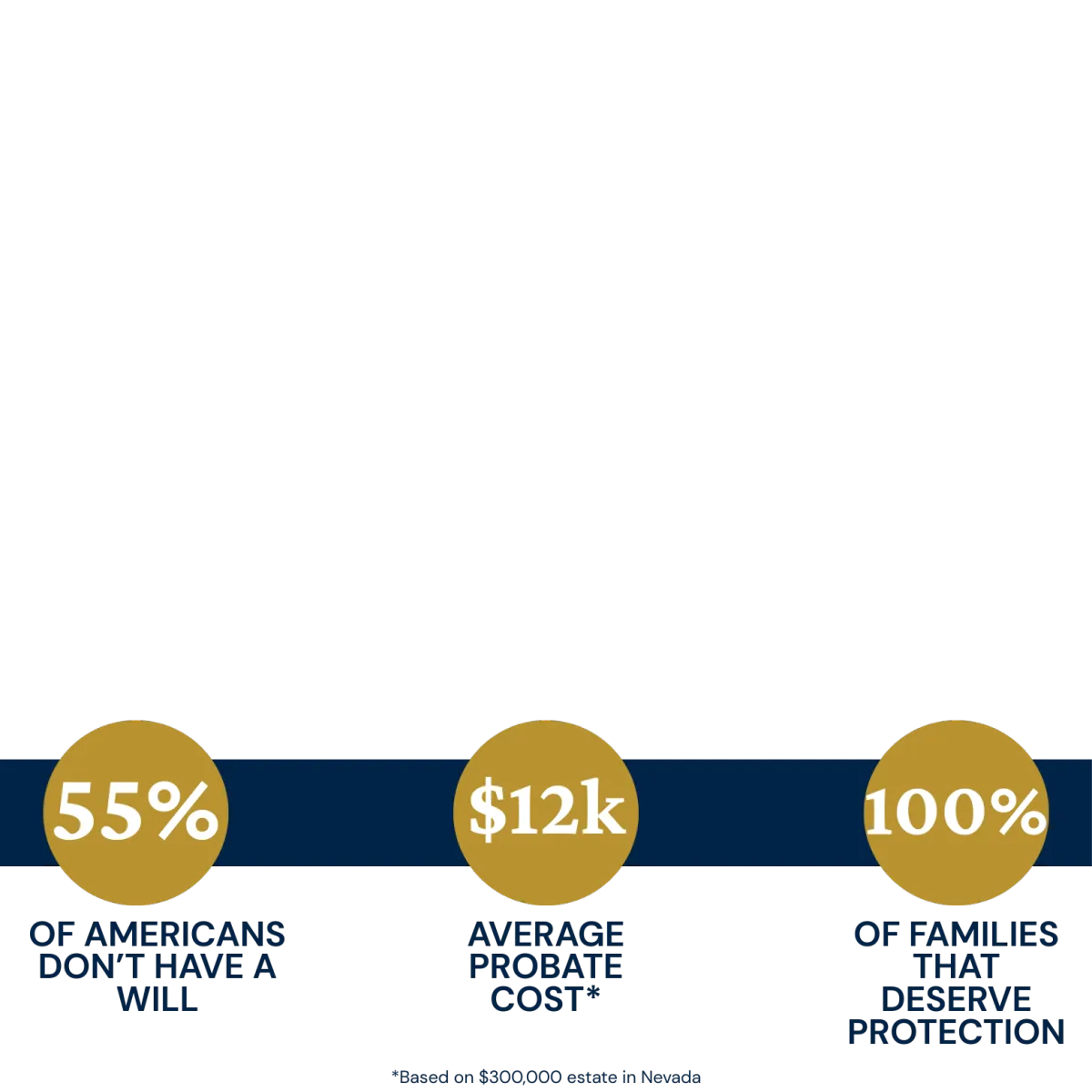

The perceived cost of estate planning stops many from even exploring their options.

The Truth: The cost of NOT having a plan is far greater. Without proper planning, your family faces potential legal fees, court costs, and family disputes that cost thousands more. We offer transparent, affordable options for every situation.

"My Family Will Figure It Out"

Some assume loved ones will handle everything without formal planning.

Without clear documentation, your family faces difficult decisions during an already emotional time. Estate planning is an act of love—it removes uncertainty and prevents family conflict when they need clarity most.

Who We Are

Estate Planning Advisors of America is a modern estate planning firm built around one simple belief: families deserve clarity, not confusion.

We guide individuals, couples, and families through the estate planning process using lawyer-backed, state-specific technology combined with real human support. Our trained Estate Planning Advisors take the time to understand your goals, explain your options in plain language, and ensure your plan is built, funded, and understood.

We are not a law firm, and we don’t believe estate planning should feel intimidating or inaccessible. Instead, we focus on education, guidance, and execution—helping families move from uncertainty to confidence with a process designed for real life.

At EPAOA, estate planning isn’t just about documents. It’s about protecting people, reducing stress for loved ones, and building plans that actually work when they’re needed.

50+

Years combined team Experience

Guidance Beyond the Documents

We don’t stop at trust creation. Our advisors guide clients through Funded Trust Verification™, helping ensure plans are properly aligned so they’re positioned to actually work.

Human Support, Powered by Modern Technology

Lawyer-backed, state-specific software combined with real advisors means clarity, speed, and confidence—without legal overwhelm.

Family Understanding, Not Just Paperwork

Family meetings + generated trust visualizer maps help loved ones understand how the trust works, their roles, and responsibilities, reducing confusion and conflict when it matters most.

Frequently Asked Questions

Is EPAOA a law firm?

No. Estate Planning Advisors of America (EPAOA) is not a law firm and does not provide legal advice.

We provide estate planning education, guided support, and access to lawyer-backed, state-specific estate planning software. Our trained advisors help you understand the process, make informed decisions, and ensure your plan is properly completed and funded.

How is this different from using an attorney?

Traditional attorneys often focus on document creation. EPAOA focuses on guidance, clarity, and follow-through.

We help clients:

- Understand their options in plain language

- Build a trust using lawyer-backed software

- Ensure the trust is properly funded

- Educate family members on how the plan works

Many families want support beyond paperwork. That’s where we specialize.

What is Funded Trust Verification™?

Funded Trust Verification™ is EPAOA’s guided process to help ensure your trust is properly aligned with your assets.

Creating a trust is only part of estate planning. If assets are never titled or aligned correctly, the trust may not function as intended. Our advisors walk you through this step so your plan is positioned to actually work.

What does “lawyer-backed software” mean?

The software we use is developed and maintained with oversight from licensed attorneys and is customized to comply with state-specific estate planning laws.

This allows for accurate document generation while still keeping the process efficient and accessible for clients.

Do I ever speak with a real person?

Yes. Every client works with a trained Estate Planning Advisor.

Our advisors guide you through the process, answer questions, explain documents, and help ensure nothing important is missed. You are never left to figure things out on your own.

Is the process really 100% virtual?

Yes. The entire process is conducted through secure video calls and online tools.

This allows for flexibility, convenience, and faster turnaround times—without sacrificing clarity or personal support.

In person office meetings can be arranged with your advisor if you prefer.

Can my family be involved in the process?

Yes. EPAOA offers optional family meetings and we highly encourage them, too!

These meetings help family members understand:

- How the trust works

- Their roles and responsibilities

- What happens when the plan is needed

This often reduces confusion and conflict later.

How long does the process take?

Timing varies depending on complexity and responsiveness, but most clients complete their estate plan far faster than traditional methods. Because the process is guided and virtual, there are fewer delays and less back-and-forth.

What happens if my life changes later?

Estate planning is not a one-time event.

EPAOA positions itself as a long-term partner, helping clients revisit and adjust their plans as life circumstances change—such as marriage, children, relocation, or changes in assets.

How do I get started?

It begins with a conversation.

You can schedule a free estate planning consultation to ask questions, understand your options, and decide if EPAOA is the right fit for your family.